© 2012 Chris Potter, Flickr | CC-BY | via Wylio

A range of circumstances can damage your credit. Loss of your job, getting behind on various loan payments, and carrying a high balance on your credit card can contribute to bad credit. As you begin the credit repair journey, it’s important to stay positive and to focus on doing it the right way. By having faith and taking control of the matter in a mature and morally responsible way, you can get your credit score back up again.

Ways to Repair Credit After Bankruptcy

Dire circumstances can sometimes force us to file for bankruptcy. After doing so, you must first understand where you stand. Firstly, you should know your credit score, which can be obtained for free once a year from Annual Credit Report. Know that filing for bankruptcy deeply hurts your credit (from 130 to 240 points), so prepare to see a low number. Check for any errors on the report, and notify the credit bureaus if you find any. Credit reporting errors can seriously damage your score.

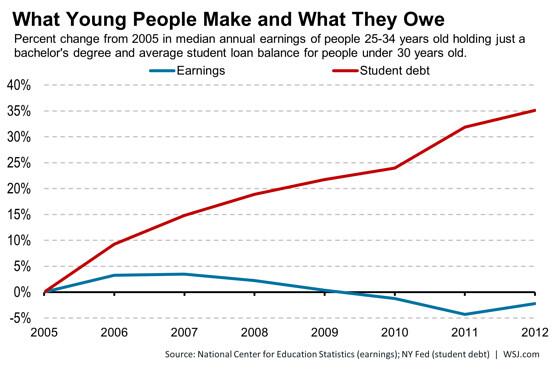

Not all types of debt can be eliminated in bankruptcy, such as tax debts and student loans. Make a chart of these debts and then highlight those that have high balances or high interest rates.

Once you have a clear picture of what you owe, you need to figure out ways to get your balances lower, as making payments on time and lowering balances is the best way to improve credit. Another option is to open new lines of credit and paying off your balance each month.

© 2014 Sean MacEntee, Flickr | CC-BY | via Wylio

Change your financial habits as well. Repent for past mistakes by setting a financial plan for the future and having the willpower to stick to it. Have payment reminders sent to you so you know when money is due. Resist the temptation to spend on things you don’t need. Self-control can help a lot here, as you can put more money in your pocket each month with simple lifestyle changes, such as eating out less, renting movies instead of going to the theater, and carpooling to work. If you can, find extra work by using your networks in the neighborhood, at church, and within your family.

Ways to Repair Credit After Foreclosure

Anything from unemployment and underemployment to overspending can cause foreclosure. Losing your home is emotionally difficult, and sometimes it’s hard to focus on getting back on track.

The first thing you should do is make sure you and your family have a safe and affordable place to live. The monthly payment shouldn’t exceed 28 percent of your monthly income. Understand that you won’t be able to get a mortgage for three to seven years. Stay patient and positive, and work to rebuild your credit during this time.

Address your current financial situation and review all your debts. Plan to pay those with the highest interest rates and balances first. View your credit score, but don’t get too distraught even though it’s probably down anywhere from 85 to 160 points. Faith and the motivation to make positive changes are what you need, not negativity.

Work on ways to cut down on expenses and continue to pay down debt. Put those credit cards away unless you absolutely have to use them. Discipline is what you need right now.

Fixing your credit after falling on hard times takes patience, self-control, and willpower. It’s a long road, but the right blend of faith, lifestyle changes, and careful planning can put you on the bright road to credit recovery.

Jesse Woodhouse is a Team Lead at TopTenReviews. He is a proud husband and father and loves sports, music and the outdoors.

Dr. G. David Boyd is the Managing Director of EA Resources, a non-profit designed to equip parents and communities to minister to the needs of emerging adults.

Dr. G. David Boyd is the Managing Director of EA Resources, a non-profit designed to equip parents and communities to minister to the needs of emerging adults.

This article attempts to give an overview of student credit card use by presenting some statistics taken from Sallie Mae’s National Study of Usage Rates and Trends of Undergraduate Student Credit Card Use released in April 2009.

This article attempts to give an overview of student credit card use by presenting some statistics taken from Sallie Mae’s National Study of Usage Rates and Trends of Undergraduate Student Credit Card Use released in April 2009.

I found a great

I found a great