I wanted to share an article with my readers about living life with student debt.

I wanted to share an article with my readers about living life with student debt.

The average debt for a graduating student in 2013 was $32,500 (Source). This number continues to escalate with the rise in college tuition. This number includes an average of $3,000 in credit card debt.

If you don’t have time to read the whole article, here are a few notes:

1. Big-name schools are not always worth the big price tags.

It is important that you know that universities want your money. They NEED your money. As you step onto campus, please know that they are trying to sell you on their campus, their classes, and their reputation. Many schools say that their rankings or reputation will instantly open doorways to higher-paying jobs. In many situations, this is a marketing tool, and is not based upon real data. Jenny Hecht says, “I didn’t know that once I had my [master’s degree] nobody would care where it was from.”

2. Don’t take every loan that comes your way.

© 2007 Quazie, Flickr | CC-BY | via Wylio

Education financing is a big business, and there are many people who will gladly give you loans that you feel will lead you to your dream life. However, many students are waking up from the dream, and realizing that being buried by debt is a nightmare. Before you accept a loan, make sure that you have done your homework.

“At 18 years old, you don’t really know what you’re getting yourself into,” says Gorden, who wishes more advice had been available then. “Those last two years, I was approved for over $60,000 – for a 20-year-old, without a cosigner, with no job, no sense of a future job – and they just gave it to me.”

As a emerging adult, you will be showered with money; however, none of it is free.

3. Educational Debt can grow even after college.

While you can request loan deferment or refinance, your debt will continue to grow if you are not able to make your payments. One student wrote that she owes about $5,000 more than she did when she graduated, due to a few years when she couldn’t cover all of the interest payments. Delaying payments on a loan is a serious decision, and should not be based solely upon your dream of one day landing a higher-paying job.

4. Take time to think about how your debt will affect your future.

It is important that you take responsibility to think through your financial future. Many students bury their heads in the sand, and ignore how debt will affect them. “But you don’t really think about what it actually means to have a house worth of debt, on a higher interest rate than a mortgage, until you’re getting close to graduating and thinking about having to repay them.” There are financial on-line tools available to you to help you understand what your future loan payments will be, and how they will affect your budget.

Education is an investment. Make sure that you make a wise decisions during the journey.

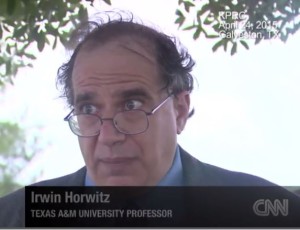

fessor in the university’s department of maritime administration, decided that he had to act.

fessor in the university’s department of maritime administration, decided that he had to act.

Dr. G. David Boyd is the Founder and Director of EA Resources. He has a passion to encourage emerging adults and their parents. If you are interested in having him speak to your community, email him at gdavid@earesources.org.

Dr. G. David Boyd is the Founder and Director of EA Resources. He has a passion to encourage emerging adults and their parents. If you are interested in having him speak to your community, email him at gdavid@earesources.org. I wanted to share an

I wanted to share an