Building A Community During the College Years

I still remember my first week of college, and the excitement and fear I felt  walking around campus. The major reason for these emotions was finding a community. I knew that in order to make the most of my college experience, I would need the security and contentment that comes from establishing a strong social network. The relationships I made grew me, changed me, and gave me the confidence to thrive in life. If you are new to campus or still struggling to find your place, here are a few things that helped me.

walking around campus. The major reason for these emotions was finding a community. I knew that in order to make the most of my college experience, I would need the security and contentment that comes from establishing a strong social network. The relationships I made grew me, changed me, and gave me the confidence to thrive in life. If you are new to campus or still struggling to find your place, here are a few things that helped me.

1. Take Social Risks

During high school, I started a new school, and was too afraid to take social risks. I remember standing in the lunch line, and the comfort it gave me. The lunch line represented safety, it gave me the right to talk to anyone. The sea of faces each lungch period overwhelmed me, and I could not gain the courage to engage with new people. I would not make this mistake again.

In the rush of unpacking my room and finding my way around campus, I realized my first priority required engaging with others. I walked up to strangers and asked if I could eat with them, I listened to others, offered comfort , stayed up late, and found my place. In order to be you in college you must risk rejection, and risk rejection, and risk rejection. In order to establish a community, you must put your heart on the line.

2. Choose Wisely

The college years are crucial in the formation of our identity. It is in these years we learn who we are, and who we want to be. We become like those we spend our time with. Proverbs 13:20 states, “He who walks with the wise grows wise, but a companion of fools suffers harm.” (NIV) Don’t limit yourself to just one social circle; however, it is important to choose your closest friends wisely.

You should be purposeful.

Don’t pick your social group based on who you meet first, or who lives near you. Define the type of friend you are looking for, and search for people with those qualities. If it is your desire to follow Jesus, choose others who do the same. If you want to promote justice, seek out others who have like passions.

Choose others who are willing to sharpen you, who are different than you in good ways. In your college years learn to be nonjudgmental of others. It is a time to stop judging people for their economic status, outward beauty, race, or clothes. It is a time to seek out others different than you, and to learn from the bests parts of them. It is a time to notice and evaluate your family of origin, and to choose for yourself what to keep the same from your past and what to change. Learn how to live graciously with all of those around you including your noisy roommate, or socially awkward neighbor.

3. Friendship First

![ftflagler-washington-pictures-4376127-h[1]](http://www.earesources.org/wp-content/uploads/2013/07/ftflagler-washington-pictures-4376127-h1-e1377712949724-300x233.jpg) It is important to establish friends first, before you dive headfirst into a first semester love. High school is over, and you will meet many new potential people to date, to fall in love with, and to break up with. Take your time. Beginning a relationship early in your college experience will limit your friendship network. We used to call those couples who spent all of their time together “Velcro Couples” because they just couldn’t seem to be pulled apart. I encourage you not to be a part of one of these relationships.

It is important to establish friends first, before you dive headfirst into a first semester love. High school is over, and you will meet many new potential people to date, to fall in love with, and to break up with. Take your time. Beginning a relationship early in your college experience will limit your friendship network. We used to call those couples who spent all of their time together “Velcro Couples” because they just couldn’t seem to be pulled apart. I encourage you not to be a part of one of these relationships.

It is definitely a time of life to fall in love, but establish yourself first. In the beginning, put your friends first, and do not sacrifice your friends because you feel as if you have found true love.

College is not just about academics and careers. It is also about building a foundation of social awareness, and learning to establishing well-chosen relationships. It is about learning to take social risks, learning to be nonjudgmental and gracious to others, and learning to balance your valued relationships.

Written by Rachel Boyd. Rachel

Written by Rachel Boyd. Rachel

is the mother of Josiah(9), Andrew(7), and

Tobias(2). They currently reside in MN, but are hoping that God calls them to a warmer climate near the ocean. She is a graduate of Cedarville

University, and Grand Rapids Theological Seminary where she earned her

MA in Educational Ministries

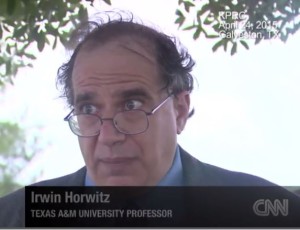

fessor in the university’s department of maritime administration, decided that he had to act.

fessor in the university’s department of maritime administration, decided that he had to act.

Dr. G. David Boyd is the Founder and Director of EA Resources. He has a passion to encourage emerging adults and their parents. If you are interested in having him speak to your community, email him at gdavid@earesources.org.

Dr. G. David Boyd is the Founder and Director of EA Resources. He has a passion to encourage emerging adults and their parents. If you are interested in having him speak to your community, email him at gdavid@earesources.org. I recently came across an

I recently came across an  The recent film “God’s Not Dead” continues to paint the picture that professors desire to destroy Christians. While some professors may be personally hostile towards a specific religion, faculty cannot discriminate against people of a specific religion, by grading their religious beliefs.

The recent film “God’s Not Dead” continues to paint the picture that professors desire to destroy Christians. While some professors may be personally hostile towards a specific religion, faculty cannot discriminate against people of a specific religion, by grading their religious beliefs. I wanted to share an

I wanted to share an

![ftflagler-washington-pictures-4376127-h[1]](http://www.earesources.org/wp-content/uploads/2013/07/ftflagler-washington-pictures-4376127-h1-e1377712949724-300x233.jpg)

![blackfriday-consumerism-materialism-1251010-h[1]](http://www.earesources.org/wp-content/uploads/2013/09/blackfriday-consumerism-materialism-1251010-h1-300x225.jpg)

![stickyfaith-parent-edition[1]](http://www.earesources.org/wp-content/uploads/2013/09/stickyfaith-parent-edition1-205x300.png)